AI-Powered Trading System

Comprehensive Guide of Our App (Share Alpha) AI Trading System

A comprehensive guide to our hybrid trading approach combining traditional analysis with machine learning

🌐 Why Use Artificial Intelligence?

Artificial Intelligence (AI) enables computers to mimic human-like decision-making by identifying patterns and making predictions based on historical data. In the context of trading, AI enhances traditional methods by analyzing massive datasets, adapting to changing market trends, and automating complex decision processes, which would be difficult or impossible for human analysts to perform efficiently.

AI systems, such as machine learning algorithms, learn from past market data and make predictions or generate signals. This makes AI a powerful tool for both novice and professional traders, as it can help improve decision-making, reduce human error, and enhance trading performance.

🚀 How Our AI-Powered Trading System Works

Our system acts like a sophisticated financial advisor that combines traditional market analysis with modern AI-driven insights. Here's how it generally operates:

1. Gathering Market Intelligence

We collect historical market data and transform it into meaningful patterns that the system can understand and learn from.

2. Learning from History

Our AI model studies years of market data to learn the patterns that often precede profitable trades.

3. Making Informed Decisions

Combining traditional trading rules with AI insights, the system generates reliable trade signals.

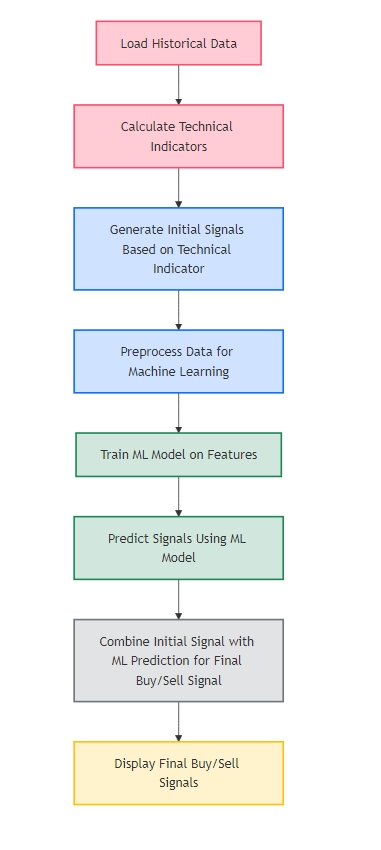

📈 System Flowchart

The flowchart below illustrates the core steps our AI-powered trading system follows from data collection to decision-making:

💻 Technical Overview

Data Preprocessing and Feature Engineering

- Technical indicators calculation: SMA, EMA, RSI, MACD

- Data normalization and standardization

- Time series feature extraction

- Handling missing data and detecting outliers

AI Model Implementation

Ensemble of decision trees (Random Forest Classifier) for signal prediction (Note: Any of AI models can be used)

Architecture: Ensemble of decision trees (n_estimators=100)

Hyperparameters: max_depth, min_samples_split, criterion

Feature Importance: Built-in ranking of technical indicators

Hybrid Signal Generation

Signal Composition:

final_signal = α * ml_prediction + (1 - α) * traditional_signal Where α is the ML confidence weight (0.0 to 1.0)

🎯 Key Benefits

Adaptive Learning

Continuously learns and adapts to changing market conditions

Risk Management

Multiple validation layers reduce false signals

Performance Tracking

Built-in metrics for strategy evaluation

Flexibility

Customizable parameters for different trading styles